Why Gold is Back in the Spotlight

- Alexander Shahin

- 6 hours ago

- 2 min read

Gold Near Record Highs — UBS Just Raised Its Forecast Again

Protect and Grow your Wealth: Why Gold Could Be the Safe Haven You Need Right Now

Why Gold Is on Everyone’s Radar

Once upon a time… Gold has always been the metal people trust in uncertain times. And today, the world feels more uncertain than ever.

Here’s what’s happening right now:

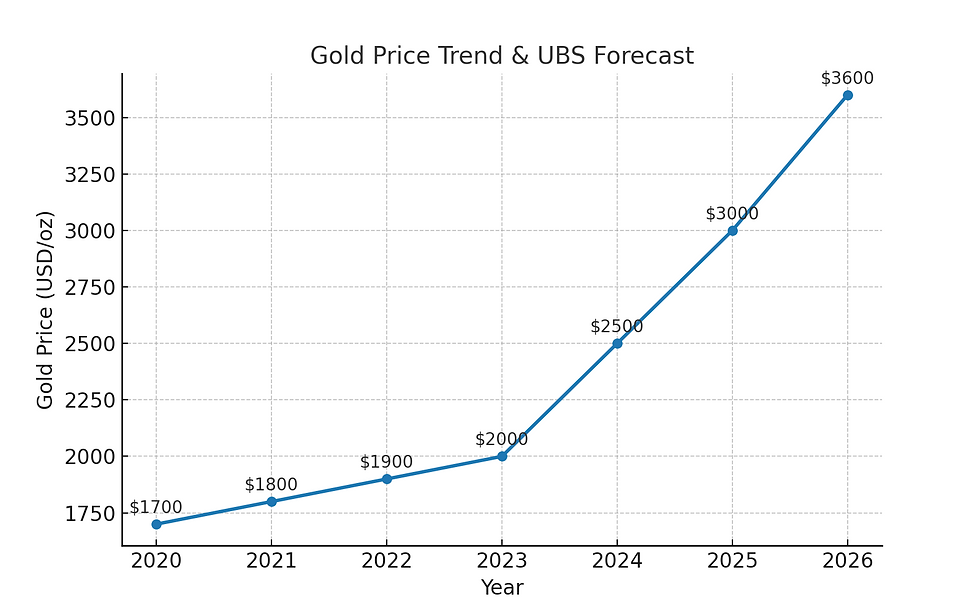

UBS, one of the world’s biggest banks, just raised its forecast for gold again.

They believe gold could reach $3,600 an ounce by early 2026 — and maybe even higher.

Why? Because people, governments, and big funds are buying gold like never before.

A timeline showing Gold prices 2020 → 2025, with UBS’s new forecast line pointing up to $3,600+ by 2026.

Think of gold as the world’s financial safety net. Here’s why UBS is so confident:

Geopolitical Drama — Tariffs, elections, and global tensions make people nervous. Nervous money runs to gold.

Central Banks Are Stocking Up — Countries like China, India, and Turkey are buying record amounts of gold.

ETFs on Fire — Investment funds that track gold are seeing huge inflows, just like in past bull markets.

Limited Supply — Mining output isn’t keeping up. More demand + limited supply = higher prices.

Weak Dollar = Strong Gold — When the U.S. dollar softens, gold tends to shine even brighter.

Who’s Buying Gold

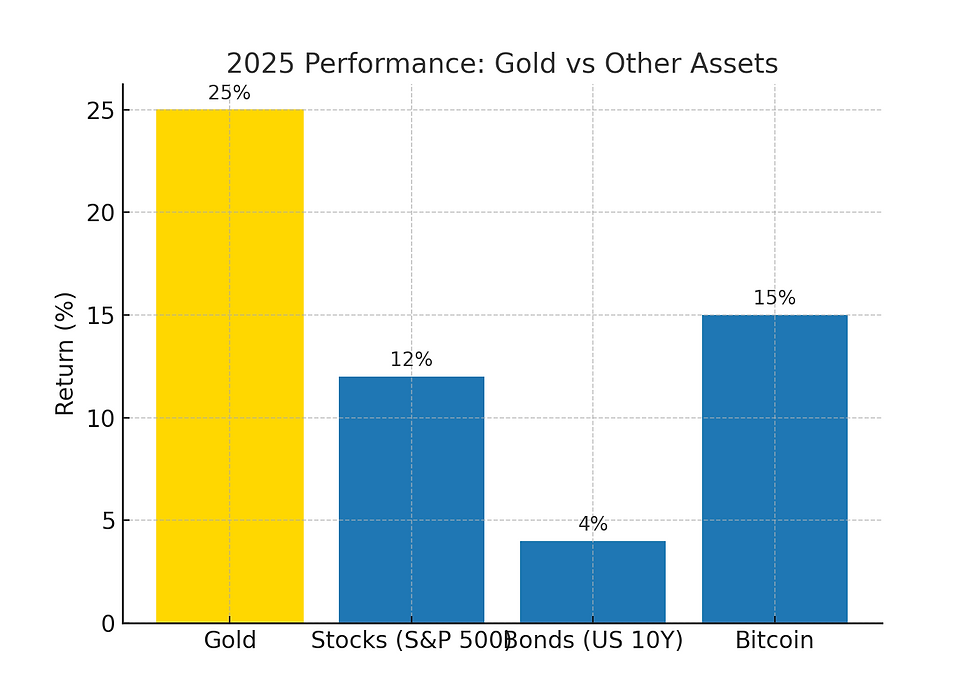

Gold vs. Everything Else

What This Means for You:

Gold isn’t about chasing quick wins. It’s about long-term protection and diversification.

If stocks stumble, gold can cushion the fall.

If inflation rises, gold often keeps its value.

If the dollar weakens, gold usually gains.

Final Takeaway

Gold is hovering near record highs — and UBS thinks this is just the beginning. Don’t wait until prices are higher. Now is the time to review your exposure and position yourself wisely.

Let’s talk about how gold can fit into your portfolio.

Contact us today for a free consultation.